A Long Road Ahead for a Systematic European NPL Approach

While Europe was united in the response to the ABS crisis back in 2008, much needs to be done to ensure a systematic European approach for non-performing loans (NPLs).

On 23 September 2020 new disclosure requirements under the Securitisation Regulation (EU) 2017/2402 entered into force for public and private Non-Performing Exposure (NPE) securitisations. For this purpose, the reporting entities need to disclose detailed information on the NPEs using the dedicated NPE add-on template.

Leading up to this addendum, the EC organised a series of workshops and corresponding action plans over the years. In addition, the European Central Bank (ECB) proposed a number of solutions in the Financial Stability Reports and the European Banking Authority (EBA) invested significant time and effort into the publication of two versions of proposed NPL reporting templates and dictionaries for whole loan portfolios (1.0 and most recently 1.1 as of September 2018). At the same time, the industry has been actively working to reduce the NPL burden in an orderly manner across jurisdictions with country-specific solutions.

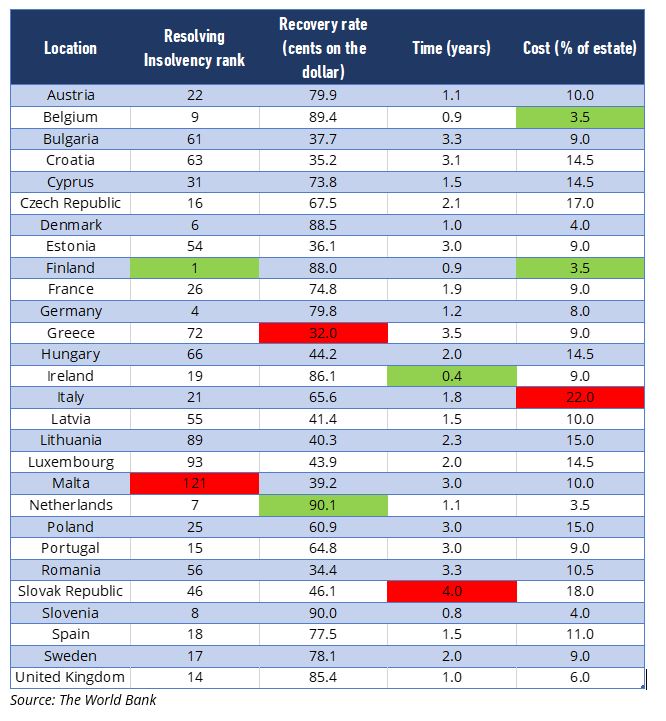

The World Bank produces a very detailed report on the “resolving insolvency” regimes. See the exhibit below for Europe.

Successful initiatives are currently underway together with a new report from the EC expected in mid-December 2020.

Below we try to summarise the various initiatives:

- The EC ABS plus NPE addendum underlying exposure templates have now come into force but it is too early draw conclusions from the EC NPE Annex 10 regarding data availability and consistency as reporting agents have only just started to fill in the required data;

- In other jurisdictions, specific schemes have been in place for years including the GACS in Italy, or more recently Hercules in Greece. The lesson learned from these two jurisdictions is that it takes time and substantial effort to collect, digitise, and make the information available to interested parties in a given format. There is generally a positive correlation between information availability and price that can be achieved when selling NPLs. However, this is a reiterative process that is costly for both buyers and sellers until both parties can reach an agreement.

- NAMA and Sareb, national asset management agencies, worked well in Ireland and Spain, respectively, focusing on the building stock as well as loans to small and medium enterprises;

Below we provide some high-level ideas that could be considered as a way forward for NPLs.

- The current reporting obligations used across Europe including investors, banks, servicers, rating agencies and other parties should converge into a single standardised, consistent and harmonised template similar to the current optional EBA templates allowing time and effort to produce the information over a period of time. The calibration of the EBA templates is an important step which takes interests from the various parties involved into consideration. A first step toward the creation of an integrated European NPL market is the introduction of a standardised, harmonised, and consistent template similar to the EBA solution. The template would take both the national specificities as well as the availability of the information into consideration particularly for seasoned NPLs.

- Servicers cannot generally enrich the NPL dataset once an NPL sale is made. This makes it very difficult to perform data enhancements or data modifications over time. That being said, a general dataset should be rolled-out for new NPLs first and then potentially to other NPLs as well as unlikely to pay.

The way forward is not easy but if Hannibal managed to cross the Alps without roads accompanied by elephants in 218 BC, we can surely plow a new path for NPLs in 2021.

For more information, please contact us at enquiries@eurodw.eu.