MONITORING THE IMPACT OF COVID-19:

Q3 2020 RMBS TRACKER

For this August 2020 update of our COVID-19 Tracker, we focused on mortgage securitisations and found that for now, COVID-19 has had more impact in terms of loan modifications than on loan performance. To read the complete PDF report for all asset classes, click here.

So far, help from governments and loan modifications by lenders helped avoid an early wave of delinquencies and defaults; we thus only noticed a small increase in delinquencies in April and May 2020. To the usual loan status categories (AR166), we have added the category “performing + flag” to identify the loans reported as “performing” but where one of the flags as per ECB guidance would have been raised. The portion of loans shown as “performing + flag” has somewhat increased in most markets in April and May, but many data providers have not yet adjusted to follow the ECB guidance on reporting for COVID-19, which means that this indicator still understates the extent of loan modifications.

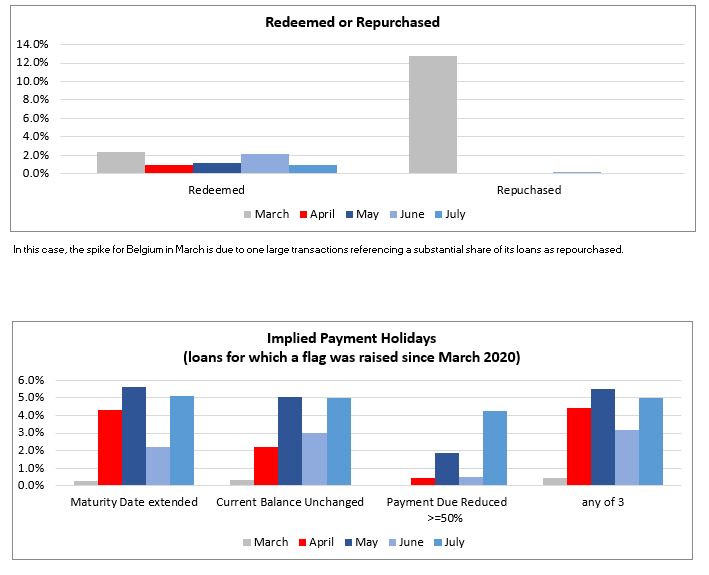

As an alternative, we have looked for loan modifications indicating possible payment holidays (see the “implied flags” tabs) such as 1) loan term increases, 2) reductions of 50% or more in the instalment due, 3) no decrease in outstanding loan amount for amortising loans and 4) cases where any of these three flags were hit during the COVID-19 period when none where hit prior to the COVID crisis. Our “Implied flags”, show a steady increase in loan modifications overtime, albeit at modest levels (around 5%) in most countries, but in the 10% range for Italy and Ireland, and 15% for Portugal and the UK.

Securitisation documentation typically sets limits to loan modifications; we have thus also had a look at the share of loans reported as redeemed and repurchased, possibly indicating that these loans were taken out of the pools. It is in the Netherlands, where performance has otherwise remained apparently excellent and where the percentage of flagged loans is smallest, that the share of loans marked as “redeemed” and “repurchased” is highest.

Please note that:

1) The results for July should be interpreted with caution, though, as only a few deals had reported data as of July 2020 at the time of writing. Most RMBS deals report quarterly, and therefore report only once a quarter

2) The data is used “as is” and reflects the reporting characteristics of the deals

3) Some data providers do not yet fully follow the ECB reporting recommendations (see the link to “reporting for COVID-19”

4) Our performance measures are intended to be comparable within a given country but may not be suitable for cross-country or cross- sector comparisons due to differing reporting and deal management practices. Even within a country, reporting practices may differ from one data provider to another, and this can have an impact on the aggregate data.

To read more, click “Download Complete Report” below.

European DataWarehouse GmbH’s research team produces a number of annual indices and special research reports to highlight current trends in European the asset-backed security (ABS) market. The data set includes more than 2.5 billion loan-level data points from commercial mortgage-backed securities (CMBS), residential mortgage-backed securities (RMBS), small business loans, auto loans, consumer finance, credit cards and other ABS transactions.

Users can access the data on the ABS platform with European DataWarehouse’s cloud-based solutions EDITOR and EDVANCE, or a standard API interface, and analyse and compare underlying portfolios.

Data used in this research is uploaded by ABS issuers to comply with European Securities and Markets Authority (ESMA) and European Central Bank (ECB) regulatory requirements for asset-backed securitisation transactions, as well as Bank of England loan level data requirements.

For custom research reports or information on how to access the loan-level data yourself, please contact us at enquiries@eurodw.eu. Furthermore, if you have conducted research with our ABS data and would like us to feature it, please email us.