COVID-19: WHO HAS BENEFITED MOST FROM COVID-ERA AUTO LOAN EXTENSIONS?

In our first publication on COVID-19, we noted that the self-employed and small business (SME) type borrowers were struggling more than others, as the “new delinquency rate” had increased more noticeably for them. In this publication, we examine the fact that this group benefitted the most from maturity extensions, a specific type of loan modification. Maturity extensions have long been used to help borrowers facing temporary payment difficulties, but during the crisis, some countries made it substantially easier for borrowers to benefit from loan modifications. This certainly boosted the number of loan modifications in general and maturity extensions in particular. In this paper, we consider first loan modifications, but we note that some loans have been modified or had their maturity extended several times since the beginning of the COVID-19 crisis.

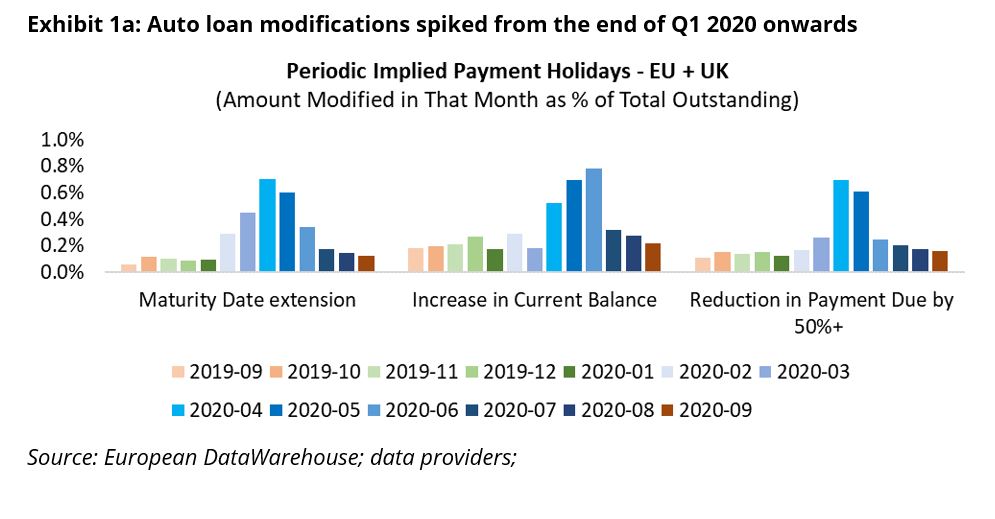

Using our auto loan data, we analysed three indicators of loan modifications, which we discussed in detail in our latest COVID-19 Tracker (Auto – November 2020). In this publication, we will be focusing on auto loans that have had a maturity extension (field “Expected Loan or Lease Maturity Date” – AA23). Looking into the borrower employment type by country, we found that the borrower categories “No employment, borrower is legal entity”, which are mostly SMEs, and the self-employed generally benefitted the most from maturity extensions.

From February 2020 onwards (see Exhibit 1a), we see a spike in loan modifications. Please note that due to a lag of up to two months between the “as of date” of the data (Pool Cut-off Date – PCD) and the upload date of the data (submission date – timestamp), data with a February 2020 PCD can in some instances reflect the status of the loans as of March or even April 2020. For more details on submission dates, please refer to our report on data timeliness. The spike comes earliest and is most noticeable for maturity extensions, suggesting that they play a key role as a loan modification marker.

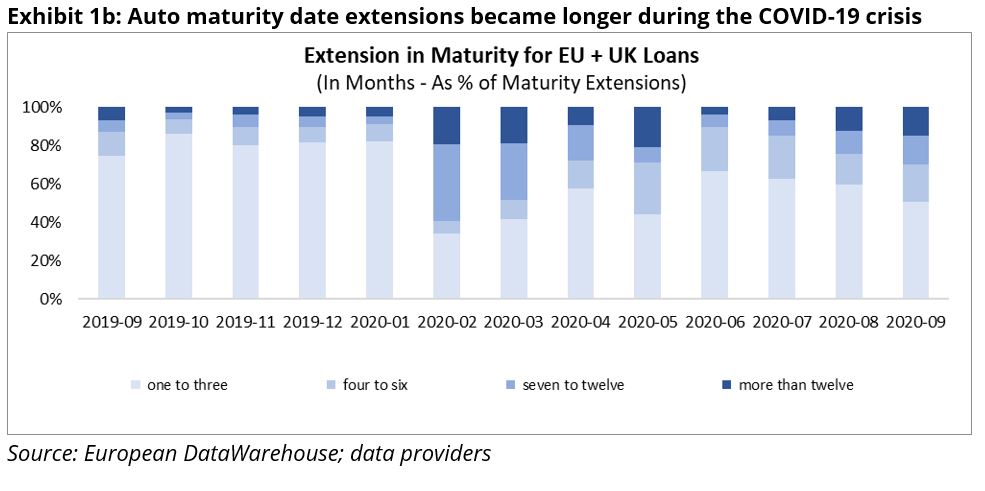

While maturity date extensions occurred even before the COVID-19 crisis, it is striking to see that the maturity extensions have increased in duration during the crisis (Exhibit 1b), suggesting that multiple payments would have to be skipped. The typical extension before the COVID-19 crisis was in the one to three months range, but from February onwards, we see longer extensions.

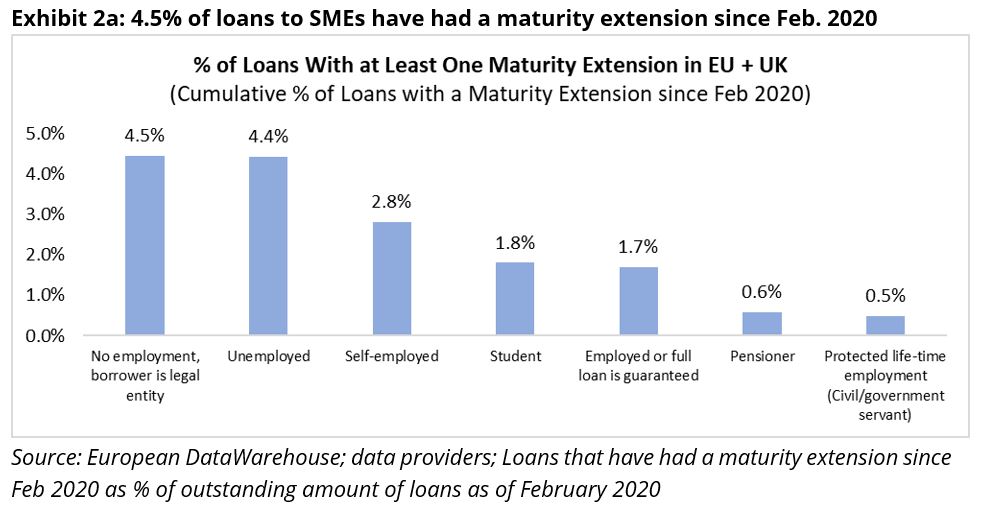

Using data on loans with at least one maturity extension in Europe (Exhibit 2a), we see that 4.5% of all loans to the borrower type “No employment, borrower is legal entity”, typically used for SMEs, has had the most extensions, followed by loans to the categories “Unemployed” and “Self-employed”. As we will see, this observation holds also when looking at individual countries.

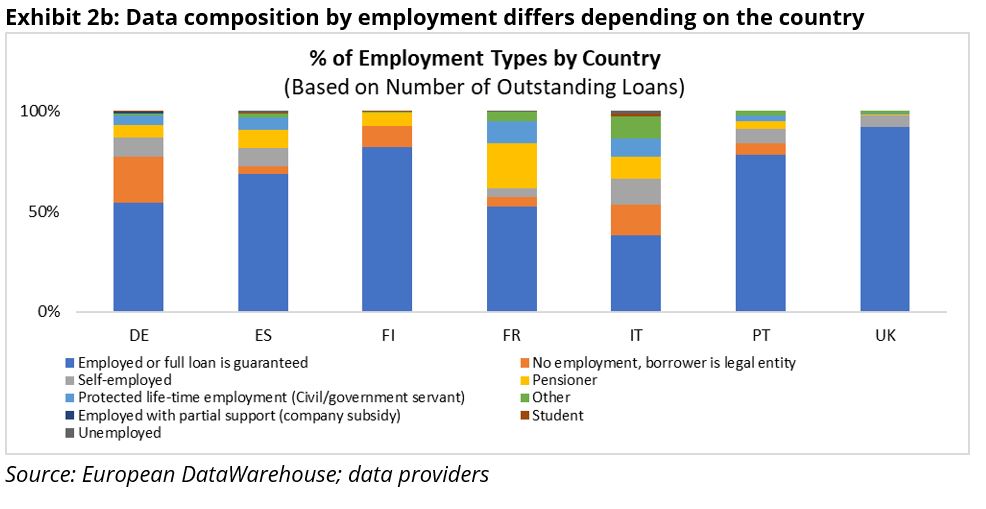

Exhibit 2b shows the prevalence of the various borrower employment types for our auto loans:

- Most loans (3.8 million) are in the “Employed or full loan is guaranteed” category

- Followed by “No employment, borrower is legal entity” (1 million), which are mostly SMEs

- The “self-employed” and “pensioners” account for about 600,000 loans each

- Lastly, there are 400,000 loans used in the analysis for government employees while the unemployed and students represent less than 100,000 loans combined

- Also, it is striking that the sample composition differs substantially from one country to the next, with more borrower diversity for Italy than for the UK for instance

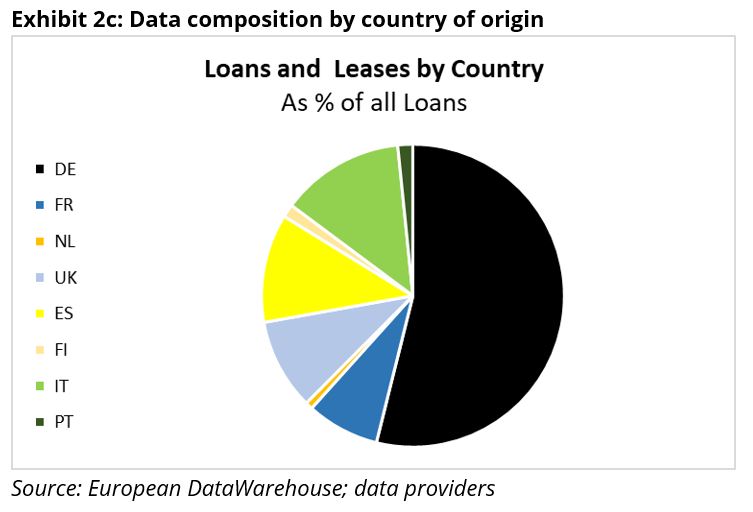

In terms of number of loans and amounts, the data comes mostly from Germany (54% or 3.7 million loans), Italy, Spain, UK and France (Exhibit 2c).

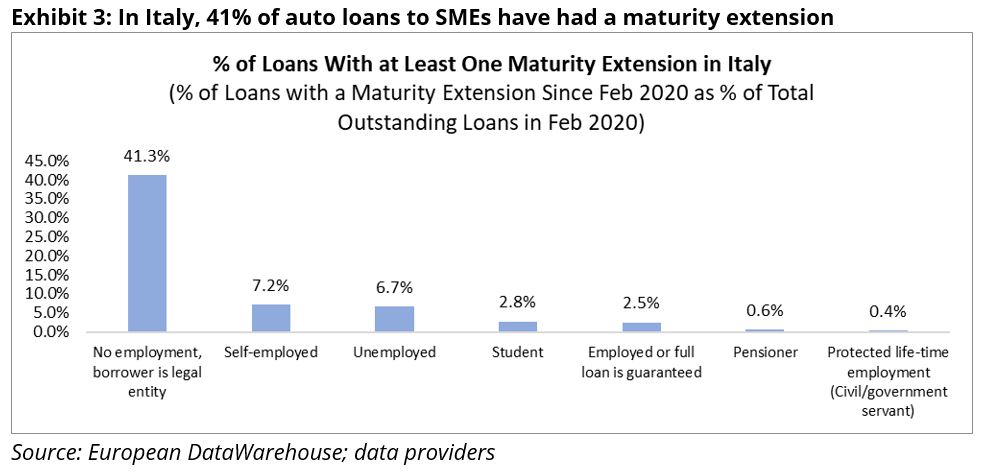

Exhibit 3 shows the results for Italy. More than 41% of all loans in the employment category “No employment, borrower is legal entity” have had a maturity extension since February 2020. This high proportion could be because Italy has enacted laws making it particularly easy for SME type borrowers to obtain loan modifications. Other categories have comparatively low numbers.

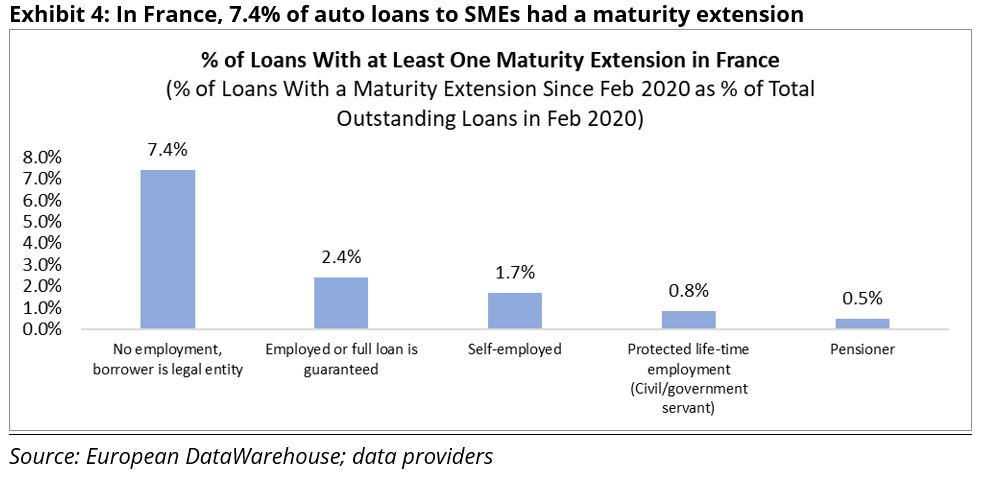

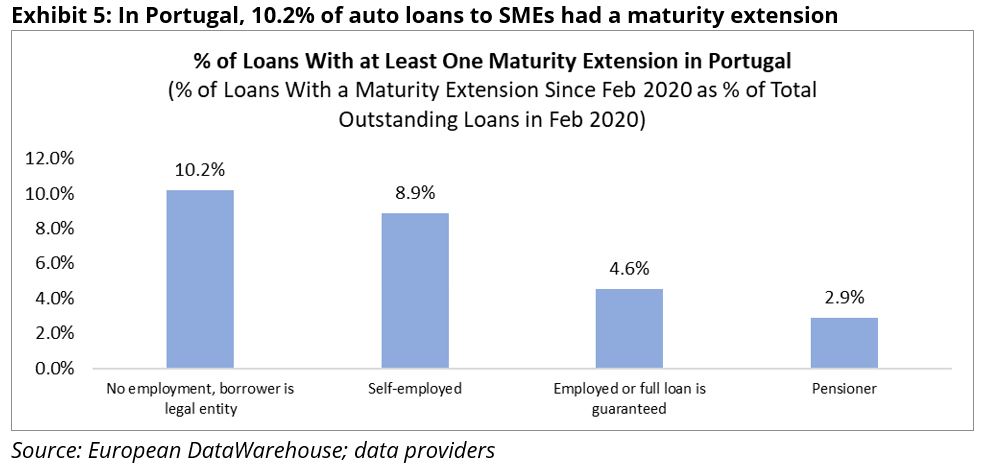

Exhibits 4 and 5 show France and Portugal, respectively. In these countries we see that the category ‘No employment, borrower is legal entity’ had the most maturity extensions while pensioners and civil servants, whose incomes are better protected, had the least maturity extensions.

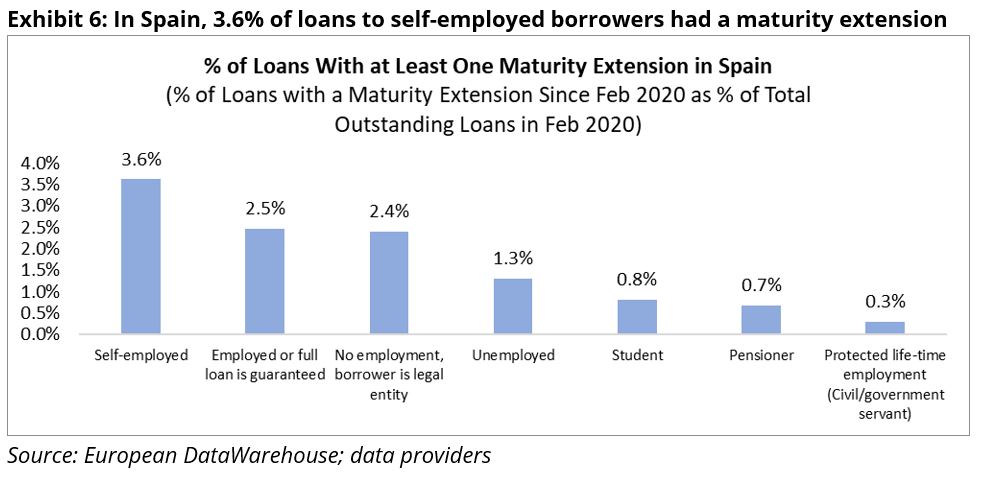

In Spain, the self-employed had more maturity extensions than other categories, as seen in Exhibit 6. Here also, pensioners and civil servants had the least loan modifications. We note that for Spain, the figures look comparatively low compared to what was seen in other countries. We noted in our COVID-19 Tracker (Auto), that the other types of observed loan modifications were also relatively low compared with other countries.

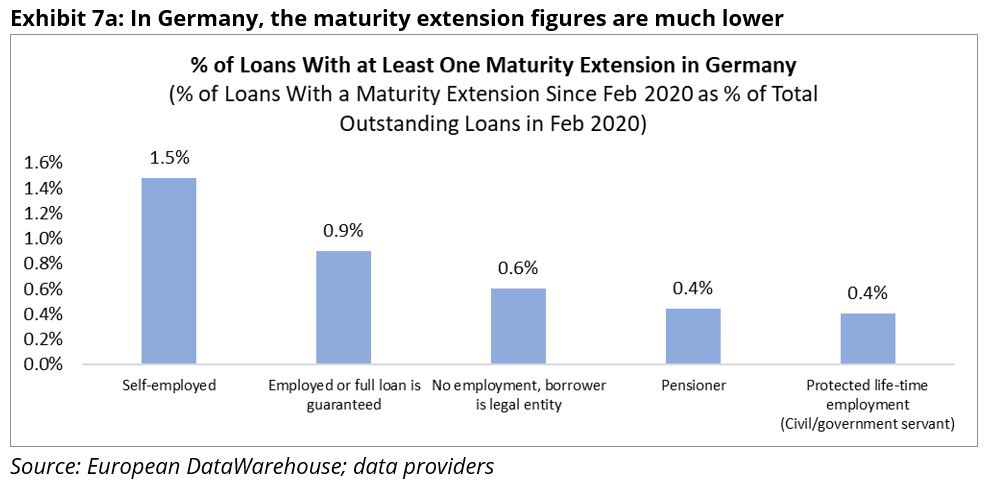

In Germany also, the self-employed are the main beneficiaries from maturity extensions (Exhibit 7a); as in other countries, pensioners and government employees had fewer loan modifications. However, we note that the ‘No employment, borrower is legal entity’ is even less likely to have had the maturity date extended than the “Employed or full loan is guaranteed” category. We also understand that the relatively low figures observed in the German auto sector is because some originators repurchased the loans modified.

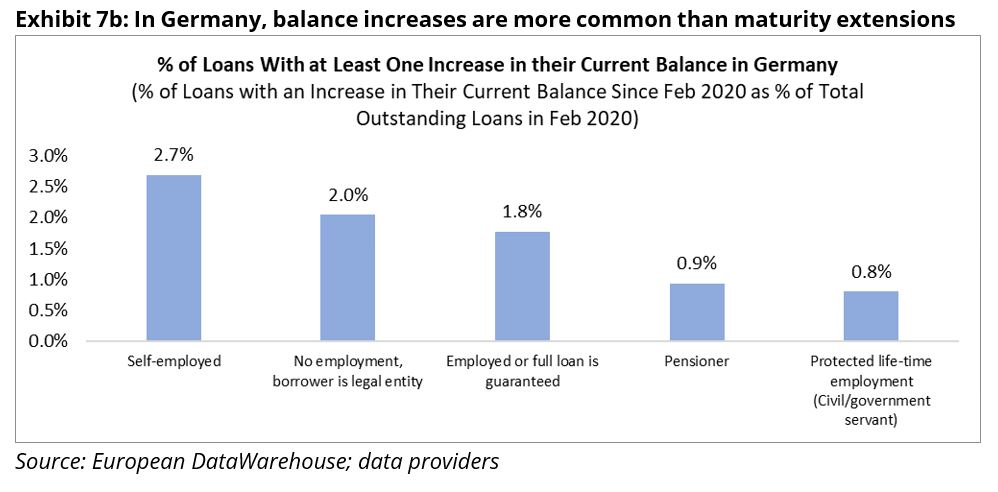

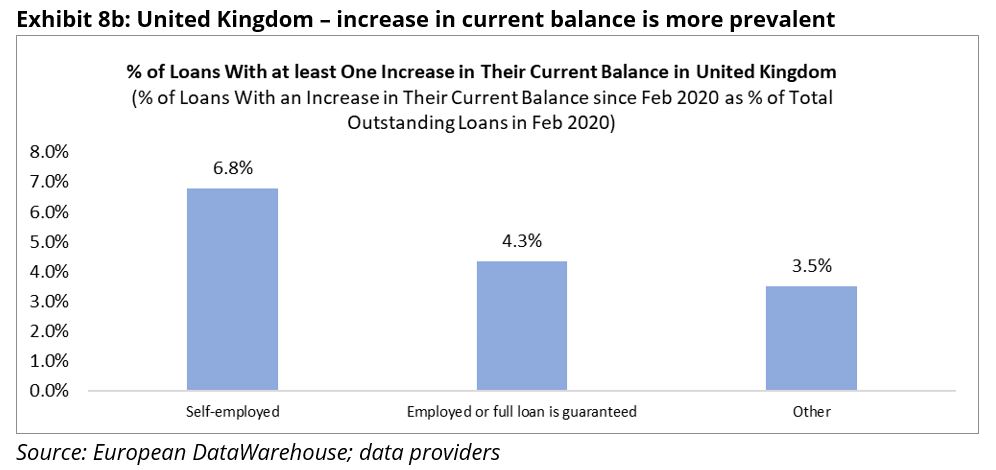

As shown previously in Exhibit 1a, three different flags were used in our COVID-19 Tracker (Auto) to track possible loan modifications and we noted that “Maturity Date” was not flagged often for Germany, while “Increase in Current Balance” was triggered more often and is arguably a better indicator for loan modifications. In Exhibit 7b, the “Increase in Current Balance” flag is used instead of the “Maturity Date” flag. This gives a slightly different picture with “No Employment, Borrower is a legal entity” as the second most likely to be flagged, after the self-employed. Also, it can be noticed that the overall numbers are slightly higher, which is probably the result of different loan management and reporting practices. One flag might be more appropriate for one country or a given type of loan.

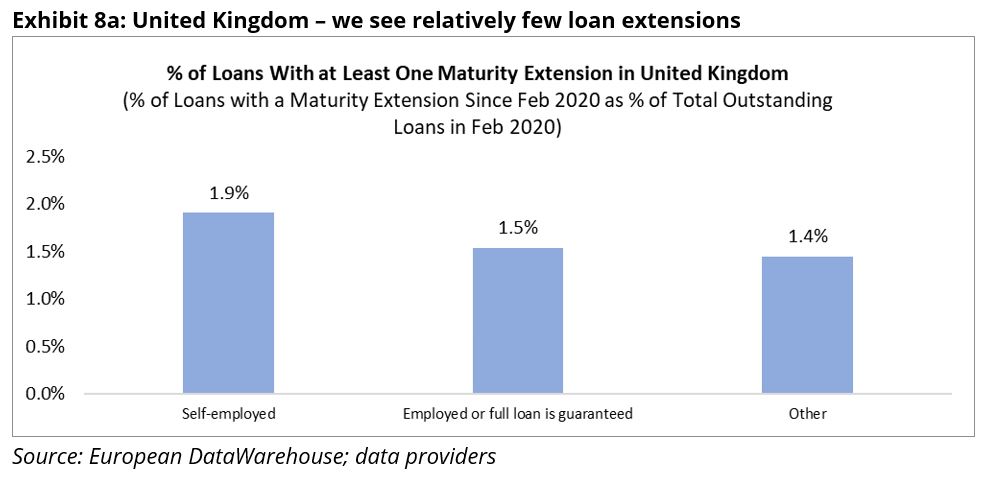

In the United Kingdom also, self-employed borrowers appear slightly more likely to have had an extension when compared to employed borrowers (Exhibit 8a). We note that in the UK, the category “No Employment, borrower is a legal entity” was not used.

Exhibit 8b shows the same results for the UK using the increased current balance flag. We see that self-employed borrowers were still the most likely to have been flagged while the numbers are also much higher. As in Germany, the “Current balance” flag appears more efficient at capturing loan modifications that the “Maturity date” flag, probably reflecting the type of auto credit used in the UK.

While maturity extensions appear to have been an early and important marker of loan modifications, using several types of flags, as done in our COVID-19 Tracker (Auto), makes it possible to account for different reporting and loan management practices.

PLEASE NOTE:

The 2020 – Q3 results published in this blog were obtained with the data available as of mid-November 2020 and are thus partially based on an incomplete data set, due to the reporting lag (see our Data Timing and Timeliness Report). Also, these results are based on securitisation data, which is not fully representative of lenders’ assets. In particular:

- a) Securitised loans tend to be of better quality than non-securitised loans

- b) Securitisation is not equally important in all countries and to all lenders

- c) Large securitisations may disproportionately affect the overall statistics

Please note also that our auto data sample includes various types of auto loans and leases. For the sake of simplicity, we refer to all as “loans” in this blog post. Please refer to our Data Availability Report Q1 2019 for an overview of data availability and concentration issues. Please do not hesitate to contact us at enquiries@eurodw.eu if you have comments/ requests/ questions.

European DataWarehouse GmbH’s research team produces a number of annual indices and special research reports to highlight current trends in European the asset-backed security (ABS) market. The data set includes more than 2.5 billion loan-level data points from commercial mortgage-backed securities (CMBS), residential mortgage-backed securities (RMBS), small business loans, auto loans, consumer finance, credit cards and other ABS transactions.

Users can access the data on the ABS platform with European DataWarehouse’s cloud-based solutions EDITOR and EDVANCE, or a standard API interface, and analyse and compare underlying portfolios.

Data used in this research is uploaded by ABS issuers to comply with European Securities and Markets Authority (ESMA) and European Central Bank (ECB) regulatory requirements for asset-backed securitisation transactions, as well as Bank of England loan level data requirements.

For custom research reports or information on how to access the loan-level data yourself, please contact us at enquiries@eurodw.eu. Furthermore, if you have conducted research with our ABS data and would like us to feature it, please email us.