MONITORING THE IMPACT OF COVID-19:

Q2 2020 REPORT

In the first months of COVID-19, our team compiled a report, “Monitoring the Impact of COVID-19”, which illustrates some of the early effects the pandemic had on auto loans, leases, and mortgages. The report shows early evidence of the effects of COVID-19 on the European economy. In addition, we have published an accompanying “COVID-19 Tracker” excel file, which will be updated regularly. The accompanying Excel file is linked within the PDF. In addition to the general “Monitoring the Impact of COVID-19” report, we have also compiled a special COVID-19 RMBS tracker. For more information on this report, please email enquiries@eurodw.eu.

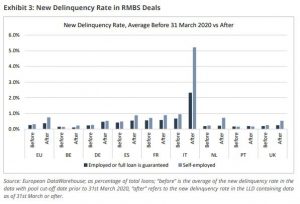

Preview: In this short paper, we will show that some of the effects of the COVID-19 crisis already became visible in the Loan Level Data (LLD) dated 31st March 2020. Most charts in this document will be made available in our COVID-19 Tracker, which we intend to update and complete on a regular basis as more data becomes available. We expect to see delinquencies rise substantially over the next months, and as of end of May, the April data indeed shows soaring arrears in several markets.

We also expect that payment holidays and other types of loan modifications will become increasingly visible in our upcoming LLD, given that clear reporting instructions are now available. Starting from a few cases in early February 2020, COVID-19 spread throughout Europe, forcing governments to enact severe social distancing measures. By the end of April, four of the countries with the greatest number of confirmed COVID-19 deaths in the world were European countries (Spain, Italy, France, UK), with more than 100,000 documented COVID-19 related deaths in total. As the death curves start to flatten (Exhibit 1), the damage to the economy takes centre stage.

To read more, click “Download Complete Report” below.

European DataWarehouse GmbH’s research team produces a number of annual indices and special research reports to highlight current trends in European the asset-backed security (ABS) market. The data set includes more than 2.5 billion loan-level data points from commercial mortgage-backed securities (CMBS), residential mortgage-backed securities (RMBS), small business loans, auto loans, consumer finance, credit cards and other ABS transactions.

Users can access the data on the ABS platform with European DataWarehouse’s cloud-based solutions EDITOR and EDVANCE, or a standard API interface, and analyse and compare underlying portfolios.

Data used in this research is uploaded by ABS issuers to comply with European Securities and Markets Authority (ESMA) and European Central Bank (ECB) regulatory requirements for asset-backed securitisation transactions, as well as Bank of England loan level data requirements.

For custom research reports or information on how to access the loan-level data yourself, please contact us at enquiries@eurodw.eu. Furthermore, if you have conducted research with our ABS data and would like us to feature it, please email us.