Impact of COVID-19 on Small Businesses and the Self-Employed: Evidence from Auto ABS Data

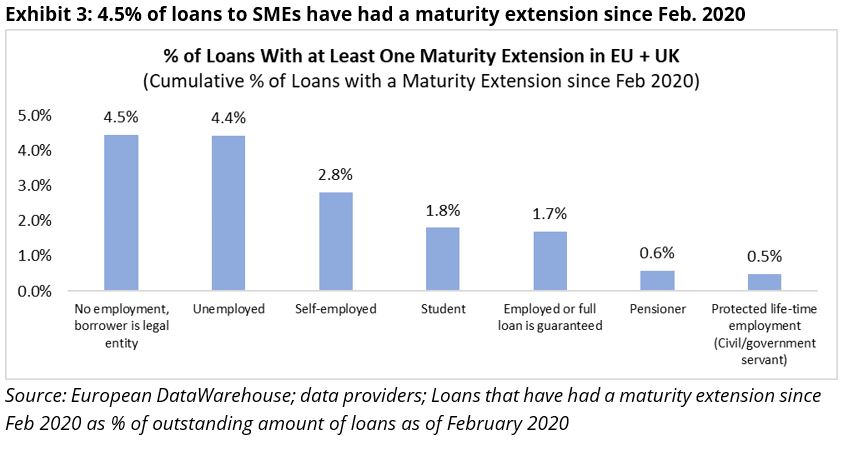

In our ABS auto data (which includes different types of loans and leases) we see that SME borrowers and the self-employed benefitted the most from maturity extensions, a specific type of loan modification which suggest that the borrowers were able to skip a payment in a time of need, therefore extending the expected life of the loan. Conversely, pensioners and civil servants used them the least. Although visible in almost all countries in Europe, this is particularly striking in our Italian data.

In our ABS auto data (which includes different types of loans and leases) we see that SME borrowers and the self-employed benefitted the most from maturity extensions, a specific type of loan modification which suggest that the borrowers were able to skip a payment in a time of need, therefore extending the expected life of the loan. Conversely, pensioners and civil servants used them the least. Although visible in almost all countries in Europe, this is particularly striking in our Italian data.

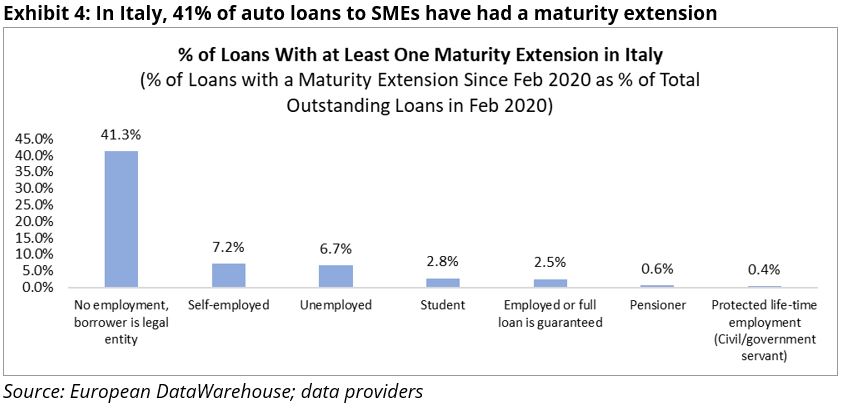

Maturity extensions have long been used to help borrowers facing temporary payment difficulties, but during the crisis, some countries such as Italy made it substantially easier for borrowers to benefit from loan modifications. This certainly boosted the number of loan modifications in general and maturity extensions in particular.

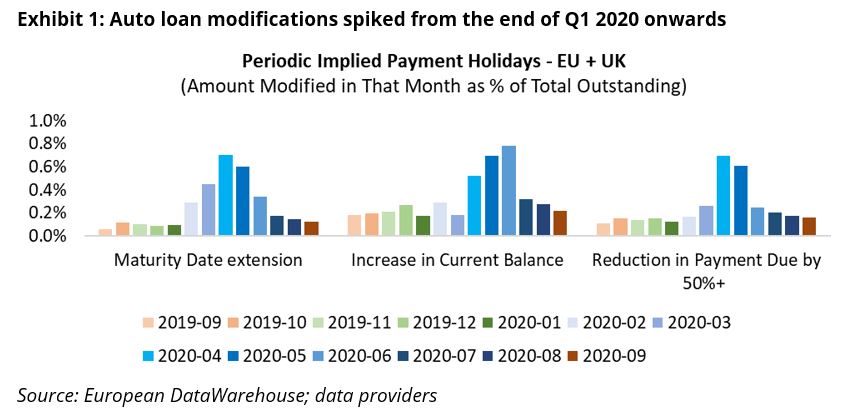

From February 2020 onwards (see Exhibit 1), we see a spike in auto loan and leases modifications. The spike comes earliest and is most noticeable for maturity extensions, suggesting that they play a key role as a loan modification marker.

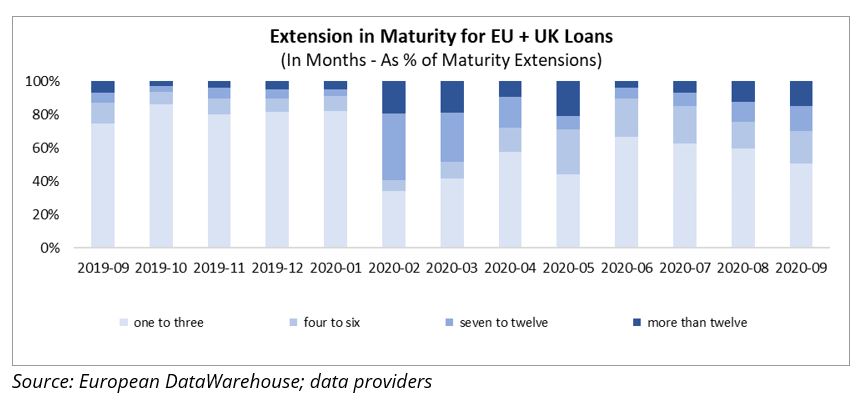

While maturity date extensions occurred even before the COVID-19 crisis, it is striking to see that maturity extensions have increased in duration during the crisis (Exhibit 2), suggesting multiple payments were skipped. The typical extension before the COVID-19 crisis was in the one to three months range, but from February onwards, we see longer extensions.

Using data on loans with at least one maturity extension in Europe (Exhibit 3), we see that 4.5% of all loans to the borrower type “No employment, borrower is legal entity”, typically used for SMEs, has had the most extensions, followed by loans to the categories “Unemployed” and “Self-employed”. This observation generally holds also when looking at individual countries.

Exhibit 4 shows that in Italy, more than 40% of all loans/leases in the employment category “No employment, borrower is legal entity” have had a maturity extension since February 2020. This high proportion could be because Italy has enacted laws making it particularly easy for SME type borrowers to obtain loan modifications. Other categories have comparatively low numbers.

Exhibit 4 shows that in Italy, more than 40% of all loans/leases in the employment category “No employment, borrower is legal entity” have had a maturity extension since February 2020. This high proportion could be because Italy has enacted laws making it particularly easy for SME type borrowers to obtain loan modifications. Other categories have comparatively low numbers.

While maturity extensions appear to have been an early and important marker of loan modifications, using several types of flags, as done in our COVID-19 Tracker (Auto), makes it possible to account for different reporting and loan management practices.

For more details, please refer to our publication on this topic “Monitoring the Impact of COVID-19: Auto” as well as our Auto COVID tracker.